Daily Current Affairs 7th March, 2024

Daily Current Affairs 7 March 2024 for Banking/Insurance/SSC and other related exams.

NATIONAL NEWS

Rajnath Singh Inaugurates Naval War College ‘Chola’ in Goa

Raksha Mantri Rajnath Singh inaugurated the new Administrative & Training building at the Naval War College (NWC), Goa. The modern edifice, named the ‘Chola’, pays homage to the mighty maritime empire of the Chola dynasty of ancient India.

- The event marked a significant milestone in the history of the NWC, reinforcing its commitment to excellence in military education and nurturing maritime thought.

- Rajnath Singh described Chola Bhawan as a symbol of the aspirations of the Navy and India’s legacy of maritime excellence. It is also a reflection of India’s new mindset of coming out of the mentality of slavery and feeling proud of our rich historical heritage – a clarion call made by Prime Minister Shri Narendra Modi from the ramparts of the Red Fort.

Piyush Goyal launches ‘e-Kisan Upaj Nidhi’ to ease farmers’ warehousing logistics

Union Minister for Consumer Affairs, Food & Public Distribution, Commerce and Industry, and Textiles, Piyush Goyal, has outlined the pivotal role of the agriculture sector in propelling India towards ‘Viksit Bharat’ by 2047.

- Speaking at the inauguration of the ‘e-Kisan Upaj Nidhi’ (Digital Gateway) by the Warehousing Development and Regulatory Authority (WDRA) in New Delhi, Goyal emphasized the significance of leveraging technology to streamline farmers’ warehousing logistics and ensure fair pricing for their produce.

- The newly launched ‘e-Kisan Upaj Nidhi’ aims to mitigate distress sales by farmers by offering simplified digital processes for storage at registered WDRA warehouses. Shri Goyal announced a reduction in security deposit charges from 3% to 1% at WDRA registered warehouses, with a focus on benefiting small-scale farmers and enhancing their income.

- The ‘e-Kisan Upaj Nidhi’ platform facilitates storage for up to six months at 7% interest per annum, providing farmers with greater flexibility and financial security. This initiative aims to incentivize farmers to utilize WDRA facilities, ensuring fair pricing and bolstering agricultural prosperity.

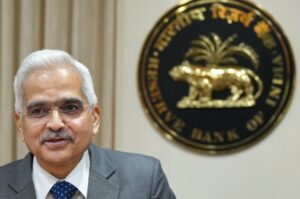

BANKING & FINANCE

RBI directs card issuers to provide options for customers to choose card networks

The Reserve Bank of India (RBI) has issued directions to card issuers not to enter into any arrangement or agreement with card networks that restrain them from availing the services of other card networks.

- As per this direction, the card issuers will have to provide an option to their eligible customers to choose from multiple card networks at the time of issue. For existing cardholders, this option needs to be provided at the time of the next renewal.

- This provision seeks to empower consumers by providing them with greater flexibility and control over their financial products.

- Additionally, the RBI has banned card issuers from entering into agreements with card networks that restrain them from availing the services of other card networks, aiming to promote fair competition and prevent anti-competitive practices.

RBI and Bank Indonesia sign MoU to establish a framework to promote use of local currencies for cross-border transactions

The Reserve Bank of India (RBI) and the Bank Indonesia (BI) signed a Memorandum of Understanding (MoU) in Mumbai for establishing a framework to promote the use of local currencies, the Indian Rupee (INR) and the Indonesian Rupiah (IDR) for cross-border transactions.

- This framework would enable exporters and importers to invoice and pay in their respective domestic currencies, which in turn would enable the development of an INR-IDR foreign exchange market. Use of local currencies would optimise costs and settlement time for transactions.

- The MoU covers all current account transactions, permissible capital account transactions, and any other economic and financial transactions as agreed upon by both countries.

Karnataka Vikas Grameena Bank launches ‘Vikas Spoorty’

Karnataka Vikas Grameena Bank (KVGB) has launched a new loan scheme called ‘Vikas Spoorty’ to strengthen the rural credit delivery system and also to motivate the common man to take up income-generating activities on a smaller scale.

- This scheme is a hassle-free loan without collateral security and surety aimed at meeting the genuine credit needs of small entrepreneurs. It links repayment of the loan to the small amounts contributed by them on a daily basis to their ‘Daily Deposit’ scheme of the bank (pigmy account) at their doorsteps.

- The loan accounts of such customers often become overdue not because of any intentional wilful default on their part, but because of the difficulty faced by them in visiting branches frequently to make repayment of small amounts.

- At the same time, on account of the subsistence level of income from their enterprises, they are not in a position to accumulate adequate savings to pay the monthly installment in one lump sum.

PNB, EaseMyTrip collaborate to introduce PNB EMT Credit Card

State-owned Punjab National Bank (PNB) announced a partnership with online travel tech platform EaseMyTrip to launch a co-branded credit card.

- This power-packed co-branded travel credit card is aimed at mass to premium customer segments and has been meticulously designed to offer a variety of rewards for Indian travellers.

- Customers can log in to pnbindia.in or PNB ONE App or easemytrip.com to avail this credit card and earn rewards in a variety of categories, including flights, hotels and holiday packages.

- These prepaid cards can be accepted on any device on the Rupay network pan India, a joint statement said.

Bandhan Financial Holdings Completes Acquisition of Aegon Life, Expanding into Digital Insurance Space

Bandhan Financial Holdings, the promoter of Bandhan Bank, has successfully acquired Aegon Life, a digital life insurance company. The deal was originally announced in July last year, which marks BFHL’s foray into the life insurance sector in India in addition to their presence in banking and mutual fund sectors.

- The acquisition extends the Bandhan group’s reach beyond banking and mutual funds. Aegon Life was previously a joint venture between Aegon India Holding BV and Bennett, Coleman & Company Ltd, the owner of The Economic Times.

- The share transfer was completed, making Bandhan Financial Holdings (BFHL) the new promoter of Aegon Life Insurance.

- The transition ensures the continuity of Aegon Life’s management team and employees. The move is expected to leverage the synergy between Aegon Life’s tech-centric operations and Bandhan’s extensive distribution capabilities for nationwide expansion.

RBI imposes ₹2 crore penalty on SBI, also fines Canara Bank, City Union Bank

Reserve Bank of India(RBI) imposed a fine of Rs 2 crore on State Bank of India (SBI) for deficiencies in regulatory compliance found in the lender’s Depositor Education Awareness Fund Scheme, 2014. Apart from that, the RBI has also imposed monetary penalties on City Union Bank of Rs 66 lakh and Canara Bank of Rs 32.30 lakh.

- The largest lender, SBI, was penalised for holding shares as pledgee of an amount over 30 per cent of the paid-up share capital of certain companies and for failing to credit an eligible amount to the Depositor Education and Awareness Fund within the period prescribed in the Banking Regulation Act (BR Act).

- In the case of Canara Bank, RBI found that the lender failed to correct rejected data and upload the same with Credit Information Companies (CICs) within seven days of receipt of such rejection report from the CICs and for restructuring accounts which are not standard assets as on March 31, 2021, as per norms related to COVID-19 related restructuring.

- Private sector lender City Union Bank had reported significant divergence between the Non-Performing Assets (NPAs) and as assessed during the inspection. Also, the bank did not put in place a system of periodic review of risk categorisation of accounts of its customers.

- The RBI took action after conducting Statutory Inspection for Supervisory Evaluation (ISE 2022) of the three lenders with reference to their financial position as on March 31, 2022.

NABARD and NRLM enter into strategic alliance to support women self-help groups

The National Bank for Agriculture and Rural Development (NABARD) and the National Rural Livelihood Mission (NRLM) have entered into a strategic alliance by inking a memorandum of understanding (MoU) to support rural women Self-Help Groups (SHGs).

- The MoU, which covers a period of 3 years, seeks to harmonize NABARD’s role as an enabler and facilitator in the SHG ecosystem, with the transformative goal of NRLM to promote women led development in rural areas by leveraging on the strengths of both entities, the development financial institution (DFI) said in a statement.

- The Deendayal Antyodaya Yojana (DAY)-NRLM will engage with respective State/UT Rural Livelihood Missions to facilitate their participation as project implementing agencies with the regional offices of NABARD under the DFI’s capacity building, skilling & entrepreneurship training of matured women SHGs.

BUSINESS & ECONOMY

India’s FY24 GDP growth could be within striking distance of 8%: SBI Ecowrap

India’s FY24 GDP growth could be within striking distance of 8 per cent even as the per capita GDP at current prices crossed ₹2 lakh mark in FY24 for the first time, says SBI’s economic research department.

- It noted that defying all estimates, the economy grew 8.4 per cent in the third quarter of 2023-24 after exhibiting more than 8 per cent growth in the preceding two quarters.

- For FY24 GDP growth is expected to increase by 7.6 per cent. It estimate Q4 (January-March) GDP growth at 5.9 per cent, which we believe is an understatement. Thus, it is most likely that FY24 GDP growth could be within striking distance of 8 per cent.

Oct-Dec GDP growth surges to 8.4%, FY24 growth now pegs at 7.6%

Strong growth in manufacturing and good performance of mining and construction pushed the economic growth in October-December quarter (Q3) of Fiscal Year 2023-24 to 8.4 per cent, defying all the expectations. Also, growth rate for full fiscal of 2023-24 upped to 7.6 per cent from earlier projection 7.3 per cent.

- Robust 8.4 per cent GDP growth in Q3 2023-24 shows the strength of Indian economy and its potential. Our efforts will continue to bring fast economic growth which shall help 140 crore Indians lead a better life and create a Viksit Bharat, Prime Minister Narendra Modi said in a tweet.

- Chief Economist Advisor V Anantha Nageshwarn hopes that like three years of post Covid (FY22, FY23 and FY24) years, FY 25 growth could be 7 per cent.

NEFT Records Highest Daily Transactions Ever

The Reserve Bank of India (RBI) announced, that the National Electronic Funds Transfer (NEFT) system had achieved a historic milestone of processing the highest-ever number of daily transactions of over 4.10 crore transactions on February 29, 2024.

- Over the past decade (2014-23), both NEFT and Real Time Gross Settlement (RTGS) grew by 700 per cent and 200 per cent respectively. In terms of volume, NEFT soared by 670 per cent and RTGS grew by 104 per cent respectively in terms of value.

- RTGS system processed its highest-ever volume of 16.25 lakh transactions in a day on March 31, 2023.

UPI transactions dip slightly in Feb due to fewer days, technical disruptions

After starting 2024 on a strong note, the Unified Payments Interface (UPI) saw transactions dip slightly in February but remain above December 2023 levels.

- Transactions worth ₹18.28-lakh crore were processed during February, nearly 1 per cent lower than the peak of ₹18.41 lakh crore in January 2024. The value of transactions was 48 per cent higher year-on-year, as per data by the National Payments Corporation of India (NPCI).

- The number of transactions on the UPI network too fell by 0.8 per cent to 1,210 crore from the January level of 1,220 crore transactions. On year, the volume of transactions was 61 per cent higher.

SPORTS

Indian shuttler B Sai Praneeth announces retirement from international badminton

Indian shuttler B Sai Praneeth has announced his retirement from international badminton. The 31-year-old battled nagging injuries since the Olympic Games in Tokyo and decided to hang his boots due to that.

- In his 24-year-long career, he won a World Championships bronze medal and represented India at the Tokyo 2020 Olympics.

- Following his retirement, Praneeth who has also won the 2017 Singapore Open, is set to begin a new innings as the head coach of the Triangle Badminton Academy in the US. He joins next month.

APPOINTMENTS

Swiss central bank head steps down in surprise move

The head of Switzerland’s central bank, Thomas Jordan, will step down in September after 12 years in charge, the bank said in a surprise statement.

- Born in 1963, Jordan entered the bank in 1997 and joined the governing board in 2007, where he had to face the effects of the financial crisis on Swiss lenders.

- In 2012 he became head of the board. Under his watch, the central bank abandoned its policy of systematically preventing the Swiss franc from rising too much against the euro.

Nayanthara appointed as the brand ambassador of Slice

Slice, the popular mango-flavored drink, has recently announced the appointment of acclaimed actress Nayanthara as its latest brand ambassador.

- This collaboration aims to strengthen Slice’s connection with its audience and reaffirm its status as the go-to beverage for mango enthusiasts.

- Nayanthara, known as the ‘Lady Superstar’ in Indian cinema, brings her charisma and wide appeal to the Slice family. With a string of critically acclaimed performances to her credit, Nayanthara resonates with audiences of all ages, making her the perfect choice to represent Slice.

Tamás Sulyok elected as Hungary’s president

Hungary’s parliament is expected to elect Constitutional Court head Tamas Sulyok as new president following the resignation of Katalin Novak, who caused outrage by pardoning a man convicted in a child abuse case.

- The affair has turned into the biggest political crisis that nationalist Prime Minister Viktor Orban has faced since his return to power in 2010.

- Orban ally Novak resigned as president earlier this month after it was revealed she had pardoned a convicted child abuser’s accomplice. Last week, ruling party Fidesz named Sulyok, 67, to replace Novak.

Future Generali India Life Insurance appoints Alok Rungta as MD & CEO

Future Generali India Life Insurance said Alok Rungta will be its managing director and chief executive officer (MD & CEO) from April 1, 2024 subject to regulatory approvals.

- Rungta, a chartered accountant, is currently deputy CEO and chief financial officer (CFO) and brings a “wealth of experience and expertise to his new role”, said the company in a statement. Bruce De Broize will serve as MD & CEO until March 31.

- Rungta has more than 25 years of experience and before becoming CFO at Future Generali he held executive positions at insurance companies in the Philippines, Hong Kong and India. He was instrumental in transforming Future Generali India’s customer acquisition, engagement, sales innovation, and digital enablement operations.

AWARDS

President Droupadi Murmu Confers Sangeet Natak Akademi Awards To Ninety-Four Eminent Artists In New Delhi

President of India Smt. Droupadi Murmu conferred Sangeet Natak Akademi Awards (AkademiPuraskar) for the years 2022 and 2023 to 91 eminent artists (two joint award) in the field of performing arts in the special investiture ceremony held at Vigyan Bhawan, New Delhi.

- Out of 94 artists selected for Akademi Awards, three (3) artists could not attend the award ceremony due to ailing health. However, Akademi will arrange to deliver their plaque and other award material to them in the coming days.

- The Akademi Awards have been conferred since 1952. These honours not only symbolize the highest standard of excellence and achievement but also recognize sustained individual work and contribution. The honour of Akademi Fellow carries a purse money of three lakh rupees, while the Akademi Award carries a purse money of one lakh rupees.

- President Murmu will also bestow the Sangeet Natak Akademi Fellowship (Akademi Ratna) to seven eminent artists in the ceremony. Sangeet Natak Akademi Fellowship is the highest honour given to eminent artists in the field of performing arts for their exceptional contribution.

1.Vinayak Khedekar, Goa , Indian Music

2.R. Visweswaran, Karnataka, Indian Music

3.SunayanaHazarilal, Maharashtra, Indiana Dance

4.Raja & Radha Reddy, Delhi, Indian Dance (Joint Fellowship)

5.Dulal Roy, Assam, Indian Theatre

6.D.P. Sinha, Uttar Pradesh, Indian Theatre

Yatin Bhaskar Duggal Wins First Prize in National Youth Parliament Festival 2024

Speaker, Lok Sabha Om Birla and Union Minister for Sports and Youth Affairs Shri Anurag Singh Thakur addressed the National Youth Parliament Festival, 2024 on its concluding day in the Central Hall of the Parliament, New Delhi.

- The National Youth Parliament is being organised this year based on the theme of ‘Young Voices: Engage and Empower for Nation’s Transformation’. The National Youth Parliament Festival, 2024 has been organised from 9th February 2024 to 6th March 2024 across the country. This Youth Parliament has been organised at three levels covering 785 Districts of the country.

- Yatin Bhaskar Duggal from Haryana won the first prize in the National Youth Parliament Festival 2024, while Vaishna Pitchai from Tamil Nadu won the second prize, and Kanishka Sharma from Rajasthan won the third prize.

SCIENCE & TECHNOLOGY

Indian Navy commissions Naval Detachment Minicoy as INS Jatayu in presence of Adm R Hari Kumar, Chief of Naval Staff

The Indian Navy commissioned INS Jatayu, at Minicoy island in the Lakshadweep Islands, its second base in Lakshadweep after INS Dweeprakshak in Kavaratti. This is the second naval base in Lakshadweep after INS Dweeprakshak in Kavaratti. Minicoy is the southernmost island of Lakshadweep and straddles the vital Sealines of Communication.

- The base will enhance operational reach and facilitate the Navy’s operational effort towards anti-piracy and anti-narcotics operations in the Arabian Sea. The commissioning of INS Jatayu will strengthen the Navy’s foothold in the Lakshadweep Islands and will usher in a new era of capacity building and comprehensive development of the island territories.

- Later in the day, the Navy commissioned its first MH-60R multi-role helicopter squadron INAS 334 ‘Seahawks’ at Kochi, a major capability boost for its rotary fleet and its anti-submarine warfare capabilities.

Click here to download 7th March 2024 Current Affairs