Daily Current Affairs 2nd & 3rd June, 2024

Daily Current Affairs 2 & 3 June 2024 for Banking/Insurance/SSC and other related exams.

NATIONAL NEWS

Hyderabad ceases to be common capital of Telangana, Andhra Pradesh

- Hyderabad, one of the bustling metropolitan cities of the country, ceased to be the common capital of Telangana and Andhra Pradesh as per the Andhra Pradesh Reorganisation Act, 2014.

- Beginning June 2, Hyderabad will be the capital city of Telangana only.Hyderabad was made the capital city of the two states for 10 years when the bifurcation of undivided Andhra Pradesh was carried out in 2014. Telangana came into existence on June 2, 2014.

- The formation of Telangana State was fulfilment of a decades-long demand when the statehood was realized on June 2, 2014 following the passage of AP Reorganisation bill in Parliament in February, 2014.

Kerala includes AI learning in school textbooks

- From this academic year, around 4 lakh students in class VII in the Kerala state syllabus schools will get to learn Artificial Intelligence (AI) with its introduction in the revised Information & Communication Technology (ICT) textbook.

- With this initiative, the state has ensured uniform exposure to AI for all students, unlike offering it as an optional subject. KITE, the technological arm of the general education department, has started AI training for 80,000 secondary school teachers.

- The new ICT textbooks will be introduced for Classes II, IV, VI, VIII, IX and X in the next academic year. One of the activities in the ‘Computer Vision’ chapter for Class VII will involve students creating their own AI programme that can recognise human facial expressions.

INTERNATIONAL NEWS

USD 135 million initiative to support SIDS tackle drivers of environmental degradation

- United Nations Development Programme (UNDP) and Global Environment Facility (GEF) has launched a USD 135 million initiative targeted at 15 Small Island Developing States (SIDS) including the Maldives, to combat environmental degradation.

- The ‘Blue and green Islands Integrated Programme (BGHP) was launched at the Fourth International Conference on Small Island Developing States (SIDS4) in Antigua and Barbuda . Under this program, SIDS will receive assistance implementing initiatives in three key sectors, which include;

1.Urban development

2.Food production

3.Tourism

- The program, managed by UNDP and funded by GEF, will support 15 out of 39 SIDS selected through a competitive “Expression of Interest” process. They include Maldives, Belize, Cape Verde, Comoros, Cuba, Mauritius, Micronesia, Palau, Papua New Guinea, Saint Lucia, Samoa, Seychelles, Timor Leste, Trinidad and Tobago, and Vanuatu.

- The fund will be disbursed following the completion of all necessary paperwork. Typically, it takes 10 to 14 months to disburse the funds. Once disbursed, projects are expected to be completed within three years.

BANKING & FINANCE

Jio Financial Services launches ‘JioFinance’ app in beta version; UPI, digital banking on offer

- To take on competitors like Google and Amazon, RIL’s financial services arm Jio Financial Services announced the launch of a pilot version of ‘JioFinance’ app to offer UPI, digital banking and other services.

- This app seamlessly integrates digital banking, UPI transactions, bill settlements, insurance advisory, and offers a consolidated view of accounts and savings, all in one user-friendly interface.

- Designed for friction-less navigation, the ‘JioFinance’ app will cater to users of all levels of familiarity with financial technology, ensuring money management on finger-tips.

- Future plans include expanding loan solutions, starting with loans on mutual funds and progressing to home loans, demonstrating a commitment to evolving customer needs.

RBI, NPCI to start work on expanding UPI to 20 countries by FY29

- The Reserve Bank of India(RBI) , along with NPCI International Payments (NIPL), will in FY25 begin work towards taking UPI to 20 countries with a completion timeline of FY29, the central bank said in its annual report for FY24.

- UPI offers features such as UPI123Pay, UPI Lite on-device wallet, linking RuPay credit cards to UPI, and processing mandates with single-block-and-multiple-debits.

- In FY24, additional features such as conversational payments, offline transactions using near field communication (NFC) technology, and pre-sanctioned credit lines from banks were added to the payment channel.

RBI imposes monetary penalty on SBM Bank (India)

- The Reserve Bank of India (RBI) said it has imposed a penalty of Rs 88.70 lakh on SBM Bank (India) for non-compliance with certain regulatory norms.

- The central banks said the penalty has been imposed for non-compliance with licensing conditions imposed by the RBI, and specific directions to stop undertaking Liberalised Remittance Scheme (LRS) transactions with immediate effect.

- The RBI said the bank was engaged business correspondents for establishing account-based relationship with customers from certain regions, despite its request being not acceded to by RBI.

UPI sets new record in May with 14 billion transactions worth over Rs 20 trillion

- Marking a record surge in the month of May, the Unified Payments Interface (UPI) network set a new record by processing 14.04 billion transactions, up from 13.3 billion in April.

- The data released by NPCI said that in terms of value, the UPI transactions amounted to Rs 20.45 lakh crore in May, compared to Rs 19.64 lakh crore in April. Notably in April, the network saw a 1% decline to 13.3 billion transactions from 13.44 billion in March.

- As per the NPCI data, the May figures were 49% up in volume and 39% up in value compared to the same month in 2023. May numbers were the highest in terms of value and volume since UPI turned operational in April 2016. The FASTag transactions increased by 6% to 347 million compared to 328 million in April.

- The average daily transaction in May amounts to Rs 65,966 crore, with an average daily transaction count of 453 million, reflecting a 49% year-on-year growth.

HDFC Bank leads credit cards market, SBI maintains highest share in debit cards in Apr’24

- India’s largest public sector lender, the State Bank of India, remained the front runner in the Debit cards market, holding a whopping 24 per cent market share in April 2024, revealed latest data by 1Lattice.

- Top banks followed the list like Bank of Baroda which held about 10 per cent market share, followed by Canara Bank, Union Bank and HDFC Bank with approximately 6 per cent market share each and Bank of India with a 5 per cent market share.

- In the Debit cards segment, Bank of Baroda and Axis Bank recorded the highest growth, of approximately 15 per cent each on a year-on-year basis, while Canara Bank recorded 11 per cent yoy growth. Thereafter, following the lead, HDFC Bank and Union Bank registered growth of 8 per cent and 7 per cent respectively.

- In the past four years, debit and credit card transactions have grown at a CAGR of 20 per cent and 19 per cent respectively. There is said to be 71 million active credit cards in FY22, a recent report by PWC India highlighted.

- India’s largest private sector bank, HDFC Bank continued to lead the race in credit cards market with a 20 per cent share. SBI Cards, ICICI Bank and Axis Bank followed the list with 19 per cent, 17 per cent and 14 per cent market share respectively in April 2024.

- Maximum growth in this segment was seen by Bank of Baroda and IndusInd Bank with a 31 per cent yoy growth and 29 per cent yoy growth respectively, holding a market share of 2 per cent and 3 per cent respectively.

DBS Bank India, Maruti sign pact for dealer inventory funding

- Maruti Suzuki India Ltd. (MSIL) has signed a Memorandum of Understanding (MoU) with DBS Bank India Ltd. for dealer inventory funding. This will help dealers operating more than 3,863 Maruti Suzuki sales outlets across India, the automaker said.

- This partnership is a step towards providing innovative financial products to Maruti Suzuki’s extensive dealer network across the country in line with their growing business needs.

Axis Bank partners with Mastercard to launch NFC Soundbox

- Axis Bank, one of the largest private sector banks in India, announced the launch of NFC Soundbox in collaboration with Mastercard.

- An industry-first proposition for the merchant community, the new soundbox will act as an all-in-one solution allowing the users to accept Bharat QR, UPI, Tap & Pay and Tap + Pin payments.

- With this launch, Axis Bank will be the first bank in India to introduce a Soundbox that can accept Tap + Pin payments, enabling merchants to accept transactions greater than ₹5000 via card instruments.

- The device will be powered with a dual confirmation feature, providing audio cues through its speaker and visual feedback on the screen in more than seven languages, ensuring a smooth and reassuring transaction experience for both merchants and consumers.

- The new Soundbox will be powered with 4G + Wifi capability which provides superior connectivity and seamless processing of transactions. It will be capable of supporting deep integration with third-party applications as well. With Dynamic QR, the amount is automatically populated when the consumer scans the code.

Canara Bank to dilute 14.50% stake in Canara HSBC Life Insurance via IPO

- Canara Bank granted an approval for initiating the process of diluting its 14.50 per cent stake in its subsidiary Canara HSBC Life Insurance Company Ltd through an initial public offering (IPO).

- This move is pending approval from the Reserve Bank of India (RBI) and the Department of Financial Services (DFS). Currently, Canara Bank holds a 51% majority stake in the life insurance company, while HSBC Insurance (Asia Pacific) owns 26%, and Punjab National Bank holds the remaining 23%.

- In addition to the IPO, Canara Bank has also approved raising up to ₹4,000 crore via additional tier-I (AT-1) bonds in FY25 and ₹4,500 crore via tier-II bonds in the current financial year. These efforts are part of the bank’s strategy to strengthen its financial position and support its growth plans.

BUSINESS & ECONOMY

Fiscal deficit for FY24 improves to 5.63 pc of GDP

- The government’s fiscal deficit for 2023-24 stood at 5.63 per cent of the GDP, marginally better then the 5.8 per cent estimated in the Union Budget, as per official data released.

- In actual terms, the fiscal deficit, or gap between expenditure and revenue, was at Rs 16.53 lakh crore.

- In the revised estimate for 2023-24, the government had projected the fiscal deficit of Rs 17.34 lakh crore, or 5.8 per cent of the GDP, in the interim Budget tabled on February 1 in Parliament.

India’s core sector output sees 6.2% growth in April, shows govt data

- Aided by a strong show from electricity generation, coal and natural gas sectors, the output of eight core industries hit a three-month high of 6.2 per cent in April 2024, higher than the upward revised output growth of 6 per cent in March 2024.

- In comparison, the growth in output was 4.6 per cent in April 2023. However, growth in these industries was revised to 6 per cent in March, up from the government’s earlier estimate of 5.2 per cent, data released by the Department for Promotion of Industry and Internal Trade (DPIIT) showed.

- The eight sectors — coal, steel, cement, fertilisers, electricity, natural gas, refinery products, and crude oil comprise 40 per cent of India’s total industrial production. As a result, they have a significant impact on the index.

GST collection in May moderates from record high to Rs 1.73 lakh crore

- The gross Goods and Services Tax (GST) revenue for the month of May 2024 stood at ₹1.73 lakh crore. This represents a 10% year-on-year growth, driven by a strong increase in domestic transactions (up 15.3%) and slowing of imports (down 4.3%).

- After accounting for refunds, the net GST revenue for May 2024 stands at ₹1.44 lakh crore, reflecting a growth of 6.9% compared to the same period last year.

Breakdown of May 2024 Collections:

- Central Goods and Services Tax (CGST): ₹32,409 crore;

- State Goods and Services Tax (SGST): ₹40,265 crore;

- Integrated Goods and Services Tax (IGST): ₹87,781 crore, including ₹39,879 crore collected on imported goods;

- Cess: ₹12,284 crore, including ₹1,076 crore collected on imported goods.

Moody’s projects India’s GDP to expand by 6.8% in 2024

- Moody’s Ratings projected India to grow 6.8 per cent in the current year, followed by 6.5 per cent in 2025, on the back of strong economic expansion, along with post-election policy continuity.

- India’s real GDP grew 7.7 per cent in 2023, up from 6.5 per cent in 2022, driven by robust capital spending by the government and strong manufacturing activity.

UBS completes historic takeover as Credit Suisse ends

- UBS Group AG completed the historic acquisition of its former rival Credit Suisse, marking a new chapter for the Swiss financial sector as the defunct bank’s legal existence has formally ended.

- The end of Credit Suisse Group AG as a separate legal entity closes the book on a bank that played a central role in the history and development of Switzerland.The transition to a single US intermediate holding company is planned for June 7.

- Credit Suisse was rescued by the rival Switzerland-based bank in March last year in a deal worth 3.25 billion US dollars (£2.6 billion). It was a major takeover of the stricken bank which was trying to turn around its fortunes but had seen its share price tank over a matter of days.

SPORTS

India’s Dinesh Karthik announces retirement from all formats of cricket

- India and Tamil Nadu wicketkeeper-batter Dinesh Karthik announced his retirement from competitive cricket. The Indian Premier League 2024, where Karthik turned out for Royal Challengers Bengaluru, was his last tournament as a player.

- The wicketkeeper-batter made 257 appearances in IPL, scoring 4,842 runs at an average of 26.32. Karthik played for Kolkata Knight Riders, Mumbai Indians, Delhi Daredevils, and Kings XI Punjab apart from RCB.

- He last represented India during the T20 World Cup 2022 in Australia against Zimbabwe. Karthik made his national debut at the age of 19 in a One-Day International against England at Lord’s. Karthik scored 1,792 runs and nine half-centuries in 94 ODI matches. In Tests, Karthik has 1,025 runs to his name, which include a century against Bangladesh, from 42 innings. In T20Is, he scored 686 runs in 60 games.

- Karthik represented Tamil Nadu in domestic cricket and won the Syed Mushtaq Ali Trophy, the T20 competition, twice as captain — in 2006/07 and 2020-21.

Real Madrid beats Borussia Dortmund to win record-extending 15th Champions League

- Real Madrid became the UEFA Champions League holders for the record-extending 15th time as they beat Borussia Dortmund 2-0 in the final at the Wembley Stadium in London.

- Dortmund had their chances, especially in the first half but some solid defence from Real Madrid and later the attack in the second half helped the La Liga side win for the second time in three seasons as the legendary Toni Kroos bowed out from club football on a title-winning note.

- This was Carvajal’s sixth UCL title as it was for Luka Modric, Kroos and Nacho while for the manager Carlo Ancelotti, it was his fifth and third with Madrid.

England’s Brydon Carse banned for three months for betting violations

- England paceman Brydon Carse has been banned from all cricket for three months for betting violations.

- The 28-year-old, who was called into England’s 50-over World Cup squad six months ago, was given a 16-month sanction — 13 months of which have been suspended — following an anti-corruption investigation by the English game’s Cricket Regulator.

- Carse, who signed an England central contract in October, accepted the charges of placing 303 bets on various cricket matches between 2017 and 2019, though not on games in which he was playing.

Indian-American Bruhat Soma from Florida wins Scripps National Spelling Bee

- Bruhat Soma, a 12-year-old Indian-American seventh-grade student from Florida, has won the Scripps National Spelling Bee after he spelt 29 words correctly in the tiebreaker, maintaining the dominance of the children from the small ethnic community in the prestigious competition.

- Bruhat emerged victorious in the Scripps National Spelling Bee , earning more than $50,000 in cash and other prizes. His championship word was abseil, which is defined as descent in mountaineering by means of a rope looped over a projection above.

- This year’s contest came down to a tiebreaker in which Bruhat spelt 29 words correctly in 90 seconds, beating Faizan Zaki, who managed to correctly spell 20 words in the lightning round.

APPOINTMENTS

Indian badminton maestro PV Sindhu designated as the brand ambassador for Tobacco Control

- The Ministry of Health and Family Welfare, Government of India, organized an event to observe World No Tobacco Day 2024 on May 31,2024. This year’s theme, “Protecting Children from Tobacco Industry Interference,” highlights the urgent need to shield youth from the detrimental influences of tobacco consumption.

- Union Health Secretary, Shri Apurva Chandra, unveiled the key focus areas for tobacco control initiatives in 2024, which include strict enforcement of India’s National Tobacco Control Law – COTPA 2003, intensified public awareness campaigns, increasing tobacco-free educational institutions, and establishing tobacco-free villages nationwide.

- In a significant move to motivate young children and youth to steer clear of tobacco in all forms, Indian badminton maestro Ms. PV Sindhu was designated as the brand ambassador for Tobacco Control.

AWARDS

Gautam Adani reclaims title of Asia’s richest man with net worth of $111 bn

- Gautam Adani, chairman of multinational conglomerate the Adani Group, has reclaimed the title of the richest person in Asia with a net worth of $111 billion, according to the Bloomberg Billionaires Index. This came after the group’s shares rallied up to 14 per cent.

- With this, Adani has overtaken Reliance Industries’ Mukesh Ambani after nearly 5 months. Ambani stands at 12th rank with a net worth of $109 billion. He had overtaken Adani in net worth after his conglomerate’s shares crashed following the Hindenburg report last January. So far in 2024, Adani’s net worth has jumped $26.8 billion while Ambani’s wealth has increased by $12.7 billion.

- The Bloomberg Billionaires Index showed that currently, Bernard Arnault is currently the richest person in the world with a net worth of $207 billion. He is followed by Elon Musk and Jeff Bezos with total wealth of $203 billion and $199 billion respectively.

Indian healthcare AI start-up Jivi ranked world’s best

- Jivi, an Indian healthcare AI startup, co-founded by former BharatPe Chief Product Officer Ankur Jain, and GV Sanjay Reddy, Chairman, Reddy Ventures, has ranked number one on the Open Medical LLM (Large Language Model) Leaderboard.

- Jivi MedX, has surpassed well-known models such as Google’s Med-PaLM 2 and OpenAI’s GPT-4. With an astounding 91.65 average score over nine benchmark categories, Jivi MedX is well-positioned to transform the field of medical artificial intelligence.

- Jivi MedX’s exceptional performance on the Leaderboard’s nine benchmark categories signifies a monumental achievement. Surpassing the capabilities of established models like GPT-4 and Med-PaLM 2, Jivi MedX’s average score of 91.65 demonstrates its advanced proficiency in understanding and generating medical language.

SCIENCE & TECHNOLOGY

ISRO and Wipro 3D partner for space exploration with 3D-printed rocket engine

- The Indian Space Research Organisation (ISRO) and Wipro 3D have successfully manufactured a 3D-printed rocket engine, the PS4, set to power the fourth stage of the Polar Satellite Launch Vehicle (PSLV).

- The PSLV, ISRO’s workhorse launch vehicle for earth observation and scientific satellites, relies on its fourth stage, the PS4, for precise orbital placement. This stage is crucial for missions related to remote sensing, oceanography, cartography, and disaster warning, among others.

- The successful integration of the 3D-printed PS4 engine signifies a transformative step in enhancing the PSLV’s capabilities. Traditionally crafted through conventional machining and welding, the PS4 engine underwent a radical redesign using Design for Additive Manufacturing (DfAM) and Laser Powder Bed Fusion (LPBF) technology.

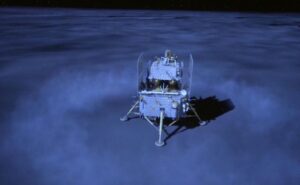

China’s Chang’e-6 successfully lands on rarely explored Moon’s far side to collect samples

- A Chinese spacecraft Chang’e-6 successfully touched down on the far side of the Moon, in the first endeavour of its kind to collect samples from this rarely explored terrain. Chang’e-6 consists of an orbiter, a returner, a lander and an ascender.

- The Chang’e-6 landed at the designated landing area in the South Pole-Aitken (SPA) Basin for the first time in human history, the China National Space Administration (CNSA) announced.

- Since its launch on May 3 this year, it has gone through various stages such as Earth-Moon transfer, near-Moon braking, lunar orbiting and landing descent. The lander-ascender combination separated from the orbiter-returner combination.