Daily Current Affairs 10th April, 2024

Daily Current Affairs 10 April 2024 for Banking/Insurance/SSC and other related exams.

NATIONAL NEWS

NTPC launches new edition of Girl Empowerment Mission

- NTPC Limited, India’s largest integrated power company, is gearing up to launch the latest edition of Girl Empowerment Mission (GEM), its flagship Corporate Social Responsibility initiative.

- The program aligns with the Government of India’s Beti Bachao, Beti Padhao initiative and aims to tackle gender inequality by nurturing girls’ imaginations and fostering their ability to explore opportunities.

- GEM does this through a 1-month workshop for young girls during summer holidays, by offering them a platform for their all-round upliftment and development.

Road ministry capex surpasses Rs 3 lakh crore in 2023-24

- The ministry of roads transport and highways recorded the highest ever capital expenditure of Rs 3.01 lakh crore in 2023-24 with both government and private expenditure at an all-time high at Rs 2.64 lakh crore and Rs 34,805 crore respectively, a senior government official said.

- The ministry constructed 12,349 km of national highways in 2023-24, the second highest so far, compared to 10,331 km in 2022-23 while the projects awarded in 2023-24 stood at 8,581 km. The highest construction so far has been 13,327 km done during 2020-21.

- According to the official, the ministry achieved the capex of 99.93% of the Rs 2,64,526 crore allocated in the last financial year, the highest in any year, compared to 99.18% in 2022-23.

Pamban bridge: India’s first vertical lift bridge over sea in Rameswaram faces ‘curve’ test

- A sharp curve in the upcoming Pamban railway bridge, India’s first vertical-lift bridge connecting the country’s mainland with Rameswaram island, has become an additional challenge for the Railways besides its mechanical peculiarity and a rough sea.

- The Rail Vikas Nigam Limited (RVNL), which is constructing this 2.08-km-long bridge, is facing a huge challenge in moving a lift span, which is 72.5-m-long, 16-m-wide and weighs 550 tonne, from the Rameshwaram end to 450 m in the sea to fix it to the bridge.

- The movement of lift span to its final fixing point shall be completed by the end of May, as it still has to be carried 370 m more.

- The RVNL has set a deadline of June 30 to make the bridge operational and its officials say that they are trying their level best to meet it.

INTERNATIONAL NEWS

EU-India join forces to promote start-up collaboration on Recycling of E-Vehicles Batteries under Trade and Technology Council

- The European Union (EU) and India launched an Expression of Interest (EoI) for startups working in Battery Recycling Technologies for Electric Vehicles (EVs) for a matchmaking event. The matchmaking aims to enhance the cooperation between European and Indian Small and Medium-sized Enterprises (SMEs) and startups in the clean and green technologies sector.

- The intended exchange of knowledge and expertise will be instrumental in advancing the circularity of rare materials and transitioning towards carbon neutrality in both India and the EU.

- This initiative takes place under the India-EU Trade & Technology Council (TTC), announced by India and the European Commission in New Delhi on 25th April 2022.

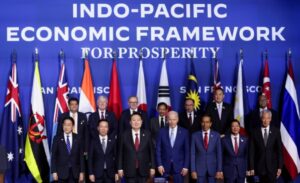

Indo-Pacific Economic Framework for Prosperity (IPEF) to organise Clean Economy Investor Forum in Singapore

- The 14-member Indo-Pacific Economic Framework (IPEF) bloc will organise an investor forum meet in Singapore on June 5-6, where domestic climate tech entrepreneurs and companies will showcase and pitch their products to global investors.

- The Indo-Pacific Economic Framework for Prosperity (IPEF) was launched in May 2022 and currently includes 14 partners – Australia, Brunei Darussalam, Fiji, India, Indonesia, Japan, the Republic of Korea, Malaysia, New Zealand, Philippines, Singapore, Thailand, United States and Vietnam.

BANKING & FINANCE

HDFC ERGO introduces Paws n Claws, an all-inclusive insurance plan that covers pet diagnostics

- HDFC ERGO General Insurance has introduced Paws n Claws, an extensive insurance policy designed for pet dogs and cats. India’s pet care industry is experiencing a consistent annual growth rate of approximately 13% and is projected to reach $800 million by 2025.

- HDFC ERGO’s ‘Paws n Claws’ provides complete pet care coverage, from diagnostics to treatments and medications, ensuring thorough protection.

- The policy is highly adaptable, featuring a ‘Make Your Plan’ option that allows customers to customize their coverage according to their requirements for injuries, illnesses, and surgeries.

Mobile wallet payments in India to surpass Rs 531 trn in 2028: GlobalData

- Mobile wallet adoption is surging in India and swiftly becoming a primary payment option, surpassing traditional methods like cash and cards.

- Over the next few years, payments via mobile wallets in India are likely to surpass the Rs 531.8 trillion mark in 2028, witnessing a compound annual growth rate (CAGR) of 18.3 per cent between 2024 and 2028, according to GlobalData – a London-based leading data and analytics company.

- The value of mobile wallet payments in India, as per a GlobalData report, grew at a CAGR of 72.1 per cent between 2019 and 2023 to reach Rs 202.8 trillion ($2.5 trillion) in 2023. This, it believes, is mainly due to the government’s concerted efforts to promote digital payment methods, most prominent being the mobile wallet-based instant payment solution—unified payments interface (UPI).

RBI launches survey of manufacturing companies

- The Reserve Bank has launched the next round of quarterly order books, inventories and capacity utilisation survey of manufacturing companies, a key input for the monetary policy formulation. The 65th round of survey is for the reference period January-March 2024 (Q4:2023-24), the central bank said.

- The Reserve Bank has been conducting the order books, inventories, and Capacity Utilisation Survey (OBICUS) of the manufacturing sector on a quarterly basis since 2008. While the survey findings are published by the RBI, it treats the company-level data as confidential and never disclosed.

- The information collected in the survey includes quantitative data on new orders received during the reference quarter, backlog of orders at the beginning of the quarter, and pending orders at the end of the quarter.

General Insurance industry grows 12.78% in FY24

- Non-life insurers posted a 12.78 per cent year-on-year (Y-o-Y) growth in gross direct premium underwritten in 2023-24 (FY24), reaching Rs 2.89 trillion, compared to 16.4 per cent in the previous financial year.

- The premium fell short of touching the Rs 3 trillion mark amid a slowdown in the growth rate of health and motor insurance, along with weak growth in the crop insurance segment.

- According to data released by the General Insurance Council, premiums of general insurers grew by 14.24 per cent Y-o-Y to Rs 2.45 trillion in FY24.

- Public sector general insurers clocked an 8.99 per cent growth in premium to Rs 90,344.49 crore, whereas their private sector counterparts witnessed a 17.53 per cent increase to Rs 1.55 trillion.

STB, PhonePe enter pact to facilitate UPI service for Indians travelling in Singapore

- The Singapore Tourism Board (STB) and Bengaluru-based fintech firm PhonePe have entered into a two-year strategic partnership to promote the Unified Payments Interface (UPI) for Indians travelling in Singapore.

- The collaboration has been built upon the existing Unified Payments Interface (UPI) linkage between India and Singapore, which allows customers to instantly make cross-border transactions between the two countries directly from their existing Indian bank accounts.

- As part of the partnership, STB and PhonePe will invest in joint marketing efforts across India and Singapore, to promote seamless UPI experiences across key tourism hotspots.

Axis Bank floats digital opening of US dollar fixed deposit at GIFT City

- Axis Bank said it has floated a digital US dollar fixed deposit (FD) scheme for NRI customers at the IFSC Banking Unit (IBU) at GIFT City, Gujarat. The FD scheme is first of its kind, and Axis Bank has become the first bank to offer a digital journey for GIFT City Deposits.

- From now on, Axis Bank’s NRI clients can invest in US dollar fixed deposits at GIFT City through ‘Open by Axis Bank,’ the mobile banking application offered by the lender.

- The US Dollar fixed deposit will offer a wide range of investment tenures from seven days up to ten years, the bank said.

PayU Unveils Industry-First Fully Managed No-Code Downpayment EMI Solution for Online Retail

- PayU, one of India’s leading digital financial services providers, is proud to announce the launch of a first-of-its-kind Downpayment EMI solution that enables customers to make a partial payment upfront while remaining can be converted into easy EMIs, making high-ticket purchases more affordable & accessible.

- PayU merchant partners can now offer their customers the flexibility to decide the downpayment amount with Credit Card EMI, and even combine UPI with Credit Card EMIs for greater affordability and convenience.

- This no-code solution offers No Cost EMI with pre-decided downpayment options and control over subvention, helping merchants increase revenues and empower customers to save on EMI interests while fulfilling their aspirations.

SBI, Standard Chartered do a CDS trade under new RBI norms

- Marking the first such transaction after the Reserve Bank of India (RBI) issued fresh guidelines for the instrument, State Bank of India and Standard Chartered Bank India carried out a Credit Default Swap (CDS) trade worth ₹25 crore. The trade involved a 1-year rupee CDS featuring REC, senior executives at Standard Chartered Bank told.

- This landmark transaction marks a pivotal moment in credit risk management and underscores the growing sophistication of financial instruments in the Indian market.

- Credit default swaps are derivative instruments that provide a form of insurance against the risk of default of the issuer of a bond.

BUSINESS & ECONOMY

India becomes net importer of finished steel in FY23-24, shows govt data

- India was a net importer of finished steel during the 2023/24 financial year that ended on March 31, according to provisional government data seen.

- The country imported 8.3 million metric tons of finished steel between April and March, up 38.1 per cent from a year earlier, the data showed.

- India’s steel mills have called for government interventions and safeguard measures against surging imports. However, the federal Ministry of Steel has resisted calls for curbs, citing strong local demand.

- Steel consumption in India jumped 13.4 per cent to 136 million metric tons during the period, reflecting buoyant demand for the alloy in one of the world’s fastest-growing economies.

India ranked third with 67 Unicorns, more Indians producing offshore startups: Hurun Report

- According to the Hurun Global Unicorn Index 2024, India for the first time recorded a decline in unicorn creation since 2017. India in 2023 had 67 unicorns, which is one less than 68 such startups last year, according to the latest Hurun Global Unicorn Index.

- The US led the list with 703 unicorns, up 37 from 2022, and China woth 340 unicorns. UK and EU ranked No 4 and No 5 in the list, respectively. The total value of the world’s unicorns have reached US$5 trillion, equivalent to last year’s GDP of Japan.

- The slowdown is mainly due to lack of investment into start-ups despite the recent stock market record highs. The report, however, noted that India produced more offshore unicorns than any other country, co-founding 109 unicorns outside of India compared to 67 in India.

- The report noted that the top 10 unicorns were in China and the US, with both countries having four each. The list is rounded off with one unicorn each from Australia and Malta.

Eight Indian states will cross the $1-trillion mark by FY47

- India’s eight states will have an over $1 trillion economy as the country moves towards becoming a developed nation by FY47, India Ratings and Research (Ind-Ra) noted in its report.

- Ind-Ra pointed out that Maharashtra will be the first to hit the $1 trillion mark, followed by Karnataka, Gujarat, and Tamil Nadu. In contrast, Uttar Pradesh will only reach the target by FY42. The states are likely to miss their goals to become a $1 trillion economy.

- West Bengal, Rajasthan and Andhra Pradesh retained their positions in terms of sixth, seventh and ninth largest economies, respectively, in FY23 in relation to FY14.

- Kerala which used to be in the top 10 in FY14 was replaced by Telangana and Madhya Pradesh entering FY23 as the eighth- and 10-largest state economies, respectively. The other notable change was Odisha emerging as the 13th-largest state economy in FY23, ahead of Punjab and Bihar.

APPOINTMENTS

Surinder Chawla resigns as Paytm Bank head effective June 2024

- Surinder Chawla, MD and CEO of Paytm Payments Bank (PPBL) has resigned as the head of company, on account of “personal reasons and to explore better career prospects”.

- Chawla will be relieved from the payments bank from the close of business hours on June 26, 2024, parent company One97 Communications notified the exchanges.

- The news comes amid reports of heavy attrition at the bank, which was forced to wind down operations effective March 15 after the Reserve Bank of India’s crackdown for several regulatory violations with respect to inadequate KYC, monitoring end use of funds and unauthorised linkages between the operations of the bank and the payments platform, Paytm.

Sushil Sharma appointed new CMD of SJVN

- Sushil Sharma, currently serving as Director (Projects) at SJVN Limited (formerly Satluj Jal Vidyut Nigam), has been appointed for the position of Chairman and Managing Director (CMD) by the Public Enterprises Selection Board (PESB).

- Sh. Sushil Sharma boasts over three decades of experience, with a significant portion of his career dedicated to SJVN. Starting as an Assistant Engineer in 1994, he has steadily progressed through various roles, demonstrating unwavering commitment and leadership qualities.

AWARDS

Chandrayaan-3 team receives 2024 John L. ‘Jack’ Swigert Jr. Award for Space Exploration

- The team from the Indian Space Research Organisation (ISRO) responsible for the Chandrayaan-3 mission’s success was honoured with the “2024 John L. ‘Jack’ Swigert Jr. Award for Space Exploration”.

- The award recognises their contribution in “raising the bar for space exploration.” Last year in August, during the Chandrayaan-3 mission, a successful landing occurred on the Moon’s south pole, marking India as the first country to achieve this feat.

- India’s Consul General in Houston, DC Manjunath, accepted the award on behalf of ISRO during the opening ceremony of the annual Space Symposium in Colorado.

Kannada poet Mamta G. Sagar wins international award

- Mamta G. Sagar, a Bengaluru-based Kannada poet, writer, academic and activist, has recently won the World Literary Prize from the World Organization of Writers (WOW) for her contributions to the world of literature.

- Dr Sagar, a facilitator at Srishti Manipal Institute of Art, Design, and Technology, known for her involvement in diverse forms of transdisciplinary creative writing and cultural industries, received the award at a ceremony in Abuja, Nigeria.

British man Russ Cook becomes first person to run length of Africa

- Extreme marathon runner Russ Cook completed his run across the entire length of Africa in Tunisia after travelling through 16 countries, with the 352-day odyssey including being robbed at gunpoint and suffering food poisoning.

- Mr. Cook started his adventure last April at Africa’s most southerly point, the South African village of L’Agulhas, and proceeded up the continent’s west coast, running a total of over 16,000 kilometres.

- Mr Cook had originally planned to complete 360 marathons in 240 days.After complications with his visas, health scares, geopolitical issues and an armed robbery, he was forced to change his route, extending the challenge.